7 Reasons Why Fintech Industry Needs Conversational AI

The Fintech industry has been seeing burgeoning growth lately. Even amid the pandemic, while the other sectors were largely impacted, Fintech and banking recorded huge gains. Fintech curbed the traditional laggard financial management and payment systems. Financial institutions that have adopted advanced technologies like Conversational AI can deliver extraordinary financial services that are secure and convenient.

Financial institutions are steadily moving towards digitalization with Fintech. From WhatsApp Chatbots to personalized experiences, new-age institutions are more dedicated to offering a better customer experience.

But why?

- Customer loyalty is now inspired by operational conveniences that a business can provide.

- The newer generation is more tech-driven than ever before.

- Personalized experiences are everywhere, and the financial sector needs them just as much.

- The customer-centric design would help businesses survive the intense competition.

Instead, what people get are:

- Incompetent support services.

- Over-complicated procedures.

- Unavailability of services.

- Long waiting period.

Need for Customer Journey Mapping In Fintech

There’s a sales funnel in every business. A potential customer converts to a real one at the far end of this sales funnel. Nonetheless, the key to assuring that the potential target keeps moving forward in the journey is to provide a seamless user experience. Even with the best products globally, a poor UX translates to lost business.

While millions remain financially excluded worldwide, tapping into user journeys of people unable to access banks or opt-out after some time can only be done by making the process more user-friendly.

That’s where Customer Journey Mapping comes in. The customer journey map is a framework that tells how a customer interacts with a business. It informs you of the most critical touch points your customers use and their corresponding experiences. Thus, your efforts become targeted, leading to better service and increased sales.

To serve them better, you need to know what they want.

Dealbreakers To Financial Institutions In Fintech

Like every industry, Fintech, too, has its limitations and challenges. Technological advancements have offered great solutions in many spheres worldwide. However, it is beneficial to any business or individual only when put to the right use.

Fintech companies are challenged to build direct relationships with customers, mitigating online frauds and hacks, low productivity levels, and more. On the technical front, Fintech has been finding it difficult to improve monitoring and tracking suspicious transactions enhancements of account security.

Moreover, financial institutions are looking for better ways to improve customer support and services, build customer loyalty, and provide seamless customer interactions and experiences. Fortunately, Conversational AI has become a way for Fintech firms to resolve these challenges.

Conversational AI In Fintech

So how does the Gupshup Conversational AI solutions benefit a financial service company? Let’s understand some use cases.

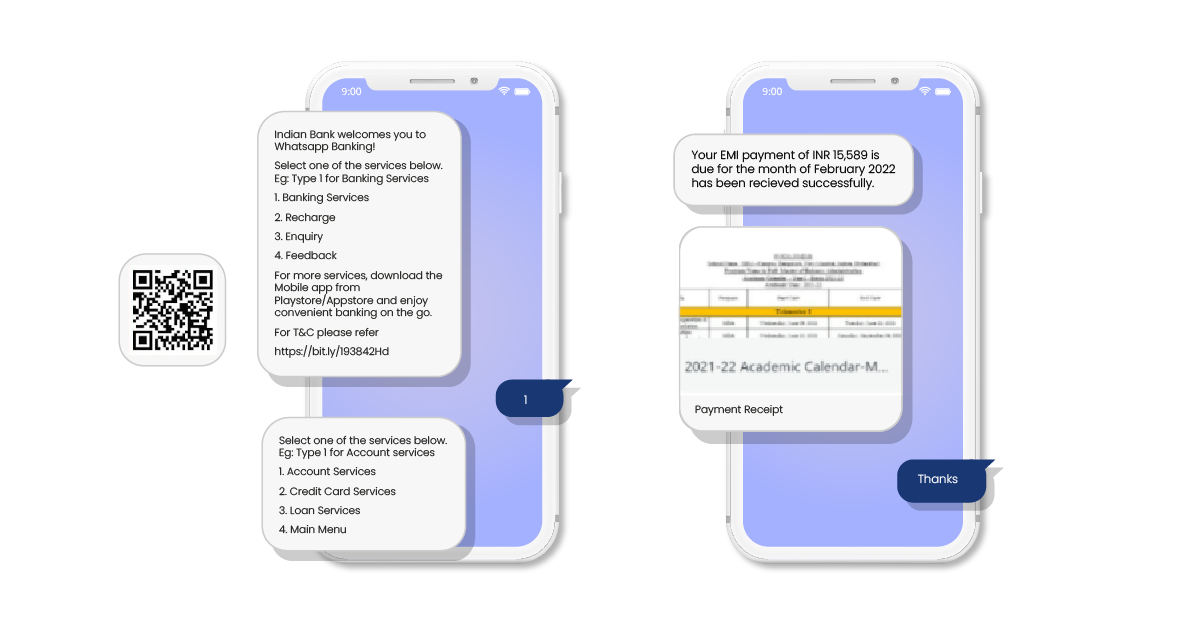

1. Easy, Error-free Banking within messaging platforms

Consumers may check their balances and accounting histories, track purchases, and obtain data just like they would if they asked any account manager to do so.

The cherry on top of the cake is that all this is done within a native communication and messaging platforms of the customers’ choice. This makes banking easy, and fun, thereby increasing loyalty.

From checking balance and available credit limit to paying your EMIs and downloading invoices for it, all banking transactions can be facilitated by Gupshup’s Conversational AI.

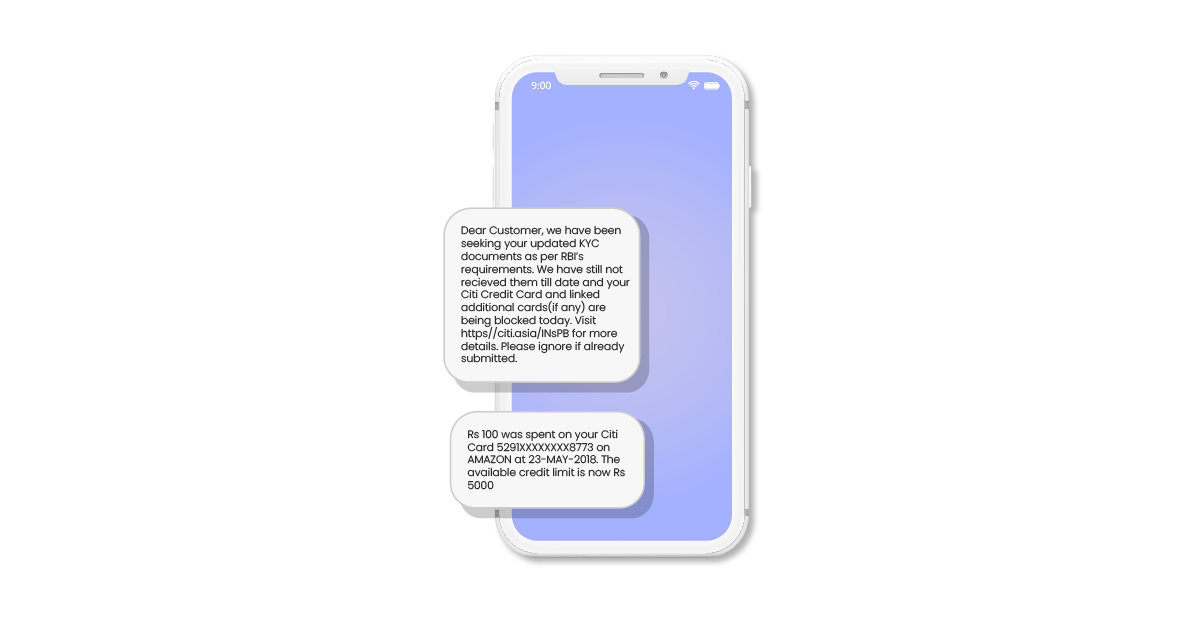

2. Easy KYC with Conversational AI

Conversational AI-powered chatbot can ask customers for all details while urging them to upload digital copies, to verify documents. Resources from the company don’t need to update customer details manually because the chatbots can smoothly integrate with most information management tools.

3. Loan applications

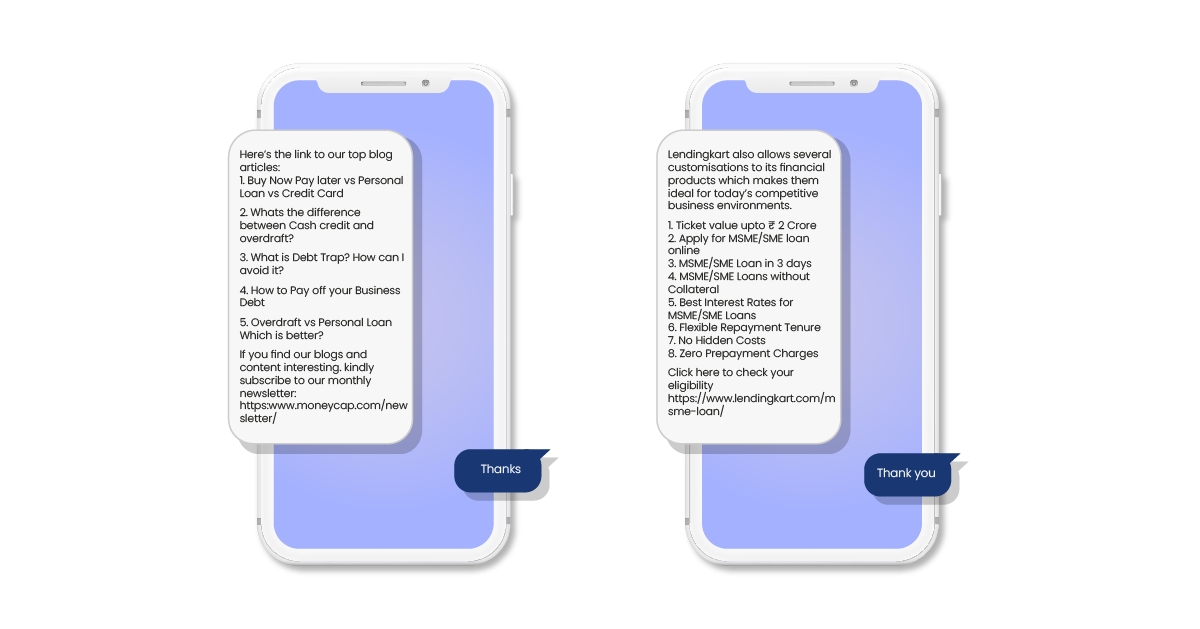

Is your customer service team contacting too many erroneous leads? Is the lending process taking too long? The chatbots can help create and assess loan applications through a seamless chat.

Fintech companies may connect with prospective borrowers in a consumer-first manner using a chatbot. The Conversational AI-powered chatbots can assist borrowers in exploring numerous loan choices while reducing the time and energy necessary to apply and qualify for credit.

Customers can check on the application status and calculate EMIs through the chatbot, all within their favorite messaging apps.

4. Transaction Alert

Keeping in touch with your customers is now easy. No more pesky emails filling up inboxes. Send updates to your customers via their favorite messaging channels via chatbots.

5. FAQs and instant customer support

Because the major application of bots is to address questions and perform actions, interactive chatbots in Fintech could be used for customer support. They can seek out material and respond to inquiries faster and more accurately than staff and are available at all times.

Chatbots can be integrated across various messaging channels such as WhatsApp, SMS, Instagram, Meta Messenger etc. They can answer frequently asked queries quickly and refer the consumers to a human agent for complex queries.

6. Omnichannel Messaging and Lead Qualification

Among the most essential applications for chatbots is chasing correct prospects online to stimulate new economic opportunities.

Organizations must identify and evaluate prospective customers who are interested in buying the product. Companies may then construct tailored communication campaigns for selected leads to turn them into customers.

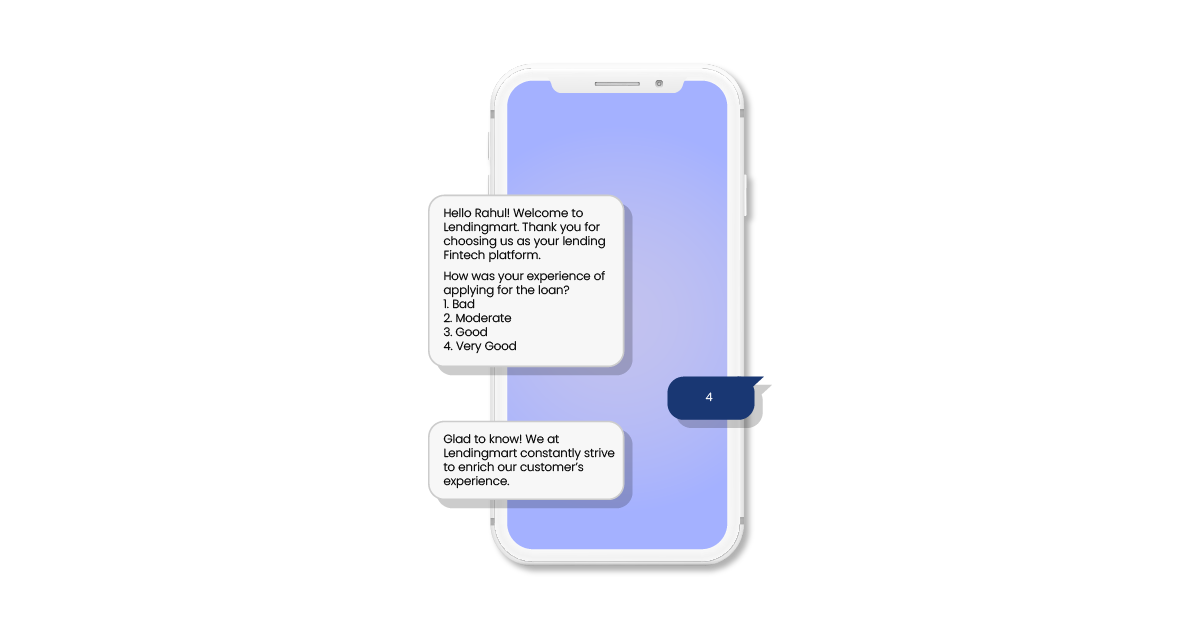

7. Referrals, Surveys and Co-Marketing

Co-marketing and Referrals have always been a cornerstone for the Fintech Industry, and chatbots help solve UX problems that your app often cannot. By bringing friendly nudges at multiple stages of the lending journey, the chatbot can push the user to send out referral codes or become a repeat customer themselves.

Conclusion

Conversational AI is a double-edged sword. It gets information from past data while collecting new data and using it as feedback to learn more. It provides a personalized user experience to users, helping them tackle issues with their specific accounts.

Conversational AI also improves customer support systems while collecting data on recurrent problems, user demographics, and common pain points. This data facilitates targeted product development along with faster issue resolution.

Benefits of Conversational AI in user journey –

- Faster & more accurate customer support.

- 24/7 availability.

- Regular improvement.

- Accurate and structured data collection.

- Seamless integration with other tools.

- Easier navigation.

- Easier self-servicing.

It is no secret that people love personalized experience, and conversational AI can provide that. Moreover, chatbots can help yield efficient results in the least amount of time if the Fintech industry masters these challenges and guarantees that the chatbots improve in security and conversational messaging. This will help drive higher adoption of chatbot usage.

The Gupshup conversational messaging solutions automates lots of business use cases of the Fintech industry. Gupshup provides Fintechs the ability to offer faster onboarding, support more secured transactions, manage and administrate day-to-day operations and provide seamless service support to customers.

Our messaging solutions include Single API and Advanced API. Integrate and transact across 30+ messaging channels using Gupshup’s single API for messaging. Across verticals, thousands of large and small businesses in emerging markets use our services to build conversational experiences across marketing, sales, and support. If you too want to introduce conversational messaging solutions for a successful customer journey, book a demo with us.